Report template: pay data fields

As Templates can be used across multiple employers, and each employer can have their own list of pay codes, your payroll product won’t validate if pay codes exist or are in use.

When adding a column, select the column type as ‘Pay Data’. This column type allows you to return pay/units from specific Pay Codes.

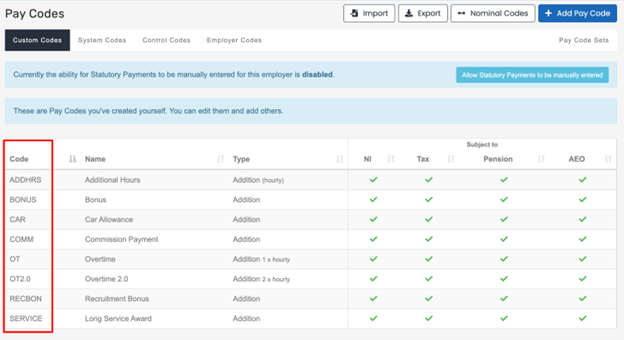

Custom Pay Codes

You can enter any Code from your list of Custom Pay Codes. When a Report is ran using that Template, the output will then show all additions and deductions for employees that used that Pay Code.

You can check the code for your Custom Pay Codes from Settings > Pay Codes

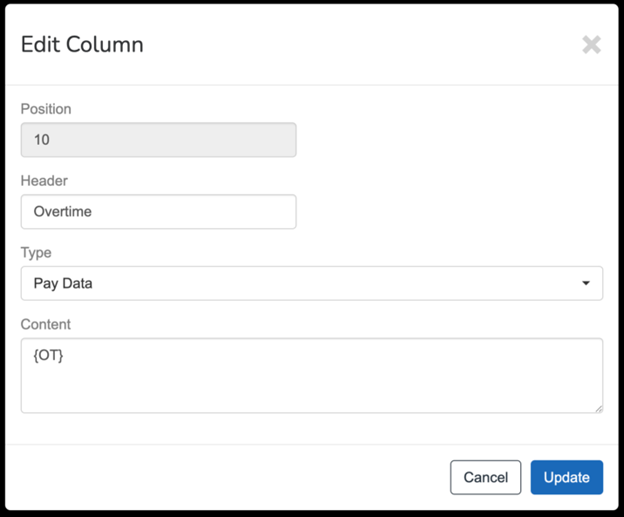

To add a Pay Code, just enter the Code surrounded by {}

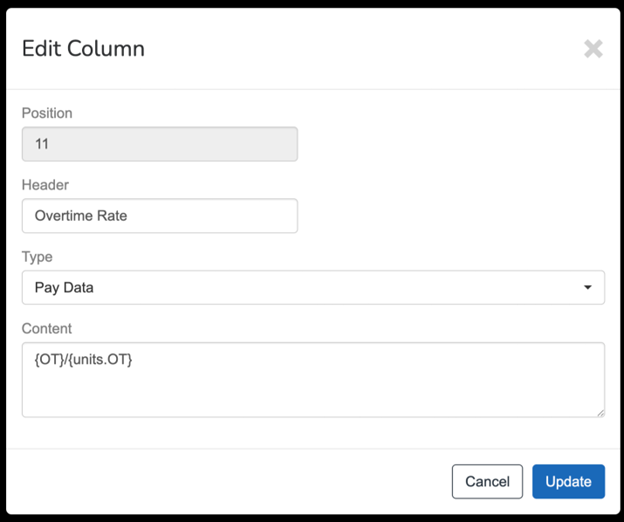

For example:

This Content would mean that any pay against Pay Code OT (Overtime) would be returned.

As Templates can be used across multiple employers, and each employer can have their own list of pay codes, your payroll product won’t validate if pay codes exist or are in use.

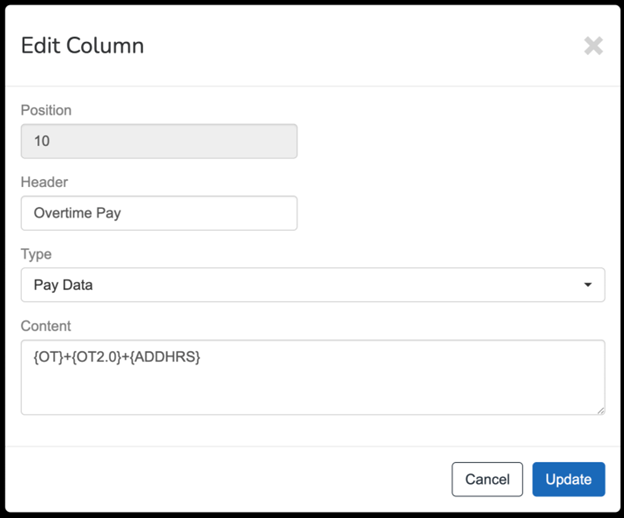

You can return pay from multiple Pay Codes in one column by just adding a + symbol between them:

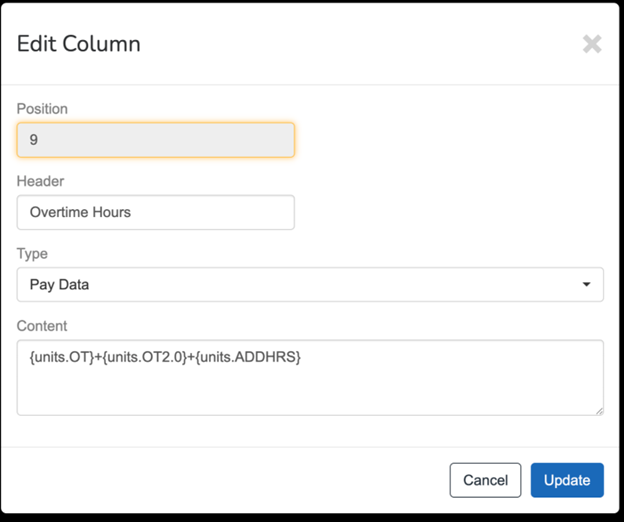

You can also return the units for Additions / Deductions that are Units x Rate

This Content would take all hours worked across additions using the three Pay Codes and return the total value.

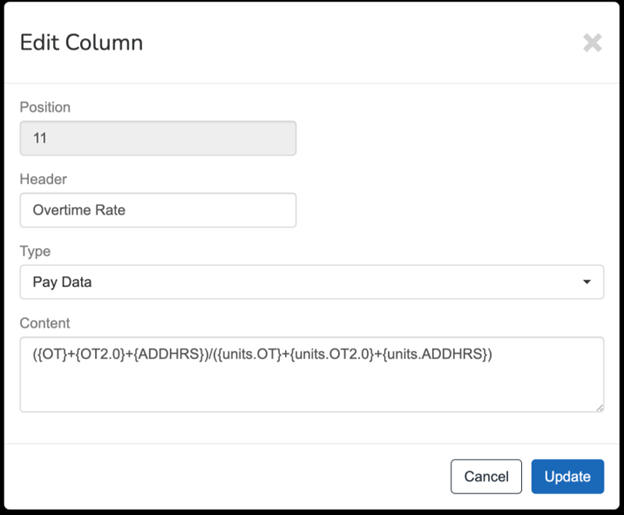

your payroll product allows employees to be paid at multiple different rates for the same Pay Code. For that reason, there’s not an option to return the rate as there could be multiple rates. However, you could do the following, and this would return the average hourly rate that all of these hours were paid at:

This is just taking the total pay for Overtime and dividing it by the total hours which will return an average pay rate.

You can do this for multiple Pay Codes as well:

System Pay Codes

As well as your Custom Pay Codes, there are System Pay Codes that can be returned in the Pay Data Column Type.

For example, if you wanted to return the Gross Pay The total amount earned by employee before taxes and other deductions are taken., just enter {GROSS}

Available Functions/Formulas

The Content for Pay Data column supports other mathematical functions as well as adding values together.

| Symbol | Function | Use Case | Example | Notes |

| + | Addition | Adding together pay across multiple Pay Codes. | {BONUS}+{RECBONUS}+{SERVICE} |

Shows the total pay in one column across 3 bonus Pay Codes. |

| - | Subtract | Subtracting pay to return one value minus another. | {GROSS}-{OT} |

Shows the total Gross Pay minus the overtime. |

| * | Multiply | Forecasting pay based on a % increase. | ({OT}+{OT1.5}+{OT2.0})*1.1 | Takes the total pay across 3 Overtime Pay Codes and increasing by 10%. |

| / | Divide | Dividing pay by hours to return an average rate. | {OT}/{units.OT} |

Takes the total pay for the Overtime Pay Code and dividing it by the total hours to return an average rate. |

Good to know...

-

If the figure is held as a negative figure within the payroll, you can show it as a positive figure by adding a plus before the code. i.e. +{LoanRepayment} will show the deduction as a positive figure.

-

If the figure is held as a positive figure within the payroll, you can show it as a negative figure by adding a minus before the code. i.e. -{gross}.