Previous year pension refunds

Need to refund pension contributions in the current tax year?

You can manually process pension contribution refunds from a previous tax year. These refunds are treated differently from standard refunds in the current tax year.

When processing a refund from a previous tax year, you'll need to submit an Earlier Year FPS (EYFPS) to HMRC His Majesty's Revenue and Customs is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, the administration of other regulatory regimes including the national minimum wage and the issuance of national insurance numbers. to ensure the employee's taxable pay and National Insurance A system of contributions paid by workers and employers in the UK, which funds various state benefits, such as the State Pension and Jobseeker's Allowance. (NI) contributions are reported correctly for the prior year.

-

Select the required company.

-

Go to Employees.

-

Select the required employee due a pension refund.

-

Select Pension.

-

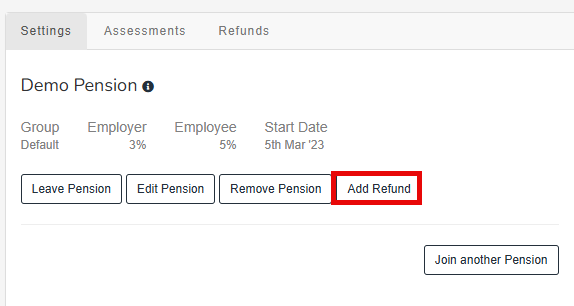

Select Add Refund.

-

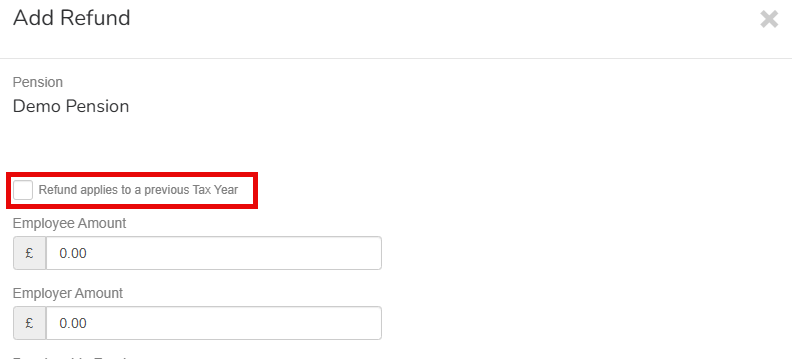

Select Refund applies to prior Tax Year.

-

Enter the details for the employee that need to be refunded from the prior tax year and select Create.

If you're processing a refund for an LGPS or Teachers' Pension, make sure to select the correct ‘Tier’ the refund applies to, and only refund the amount associated with that specific Tier. This may mean creating a refund for each tier.

Good to know...

-

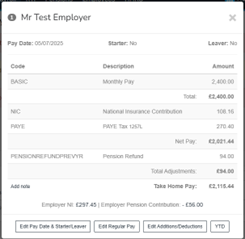

The next pay run you process the employee will receive their pension refund on a new pay code ‘PENSIONREFUNDPREVYR’.

-

The employers refund will be processed in the usual way.

-

When processing a refund from a previous tax year, you'll need to submit an Earlier Year FPS (EYFPS) to HMRC to ensure the employee's taxable pay and National Insurance (NI) contributions are reported correctly for the prior year.

We're working on...

We’re currently working on adding both employee and employer pension refunds to the Pension Contribution Summary report and including employer refunds in the main payroll reports. This functionality is expected to be available by 30th April 2025.

Important information when processing a prior year refund

-