Guide to employer verification connector (EVC)

The employer verification service is designed to help your employees simplify the process of applying for loans, mortgages, and tenancy agreements by removing the manual process, of gathering income and employment data.

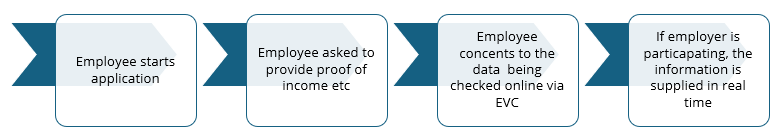

When an employee applies for a loan, mortgage or a new tenancy agreement, and if they agree to the process. Employee data is verified during the application process in real-time, reducing the time taken to process applications and, more importantly, removing the administrative burden for HR, Payroll, and all your employees.

We have partnered with Experian and Equifax.

How does it work for employees?

-

Fill in your online finance application with your chosen provider.

-

Enter your employment and income details and verify your information.

-

Consent to the verification of the payroll information.

-

The information is verified during the application process in real-time.

-

Proceed and complete your application online.

-

Sit back and wait for the decision from your service provider.

What if an employee doesn’t want to use the service?

-

Consenting to the online verification is their choice. They can still verify your information manually by contacting the employer to submit the payment and employment data to your service provider.

Will data be verified without consent?

-

No. Data will never be verified without consent.

GDPR Compliant

Data is shared under the terms of the General Data Protection Regulations (GDPR The General Data Protection Regulation (GDPR) is a data protection law which focuses on personal data.). Experian and Equifax are authorised and regulated by the Financial Conduct Authority.