Submit a payroll

The payroll area allows you to send your payroll information directly to your Payroll Specialist so they can process it for you.

| Submit a payroll

A video demonstrating how to submit a payroll. |

-

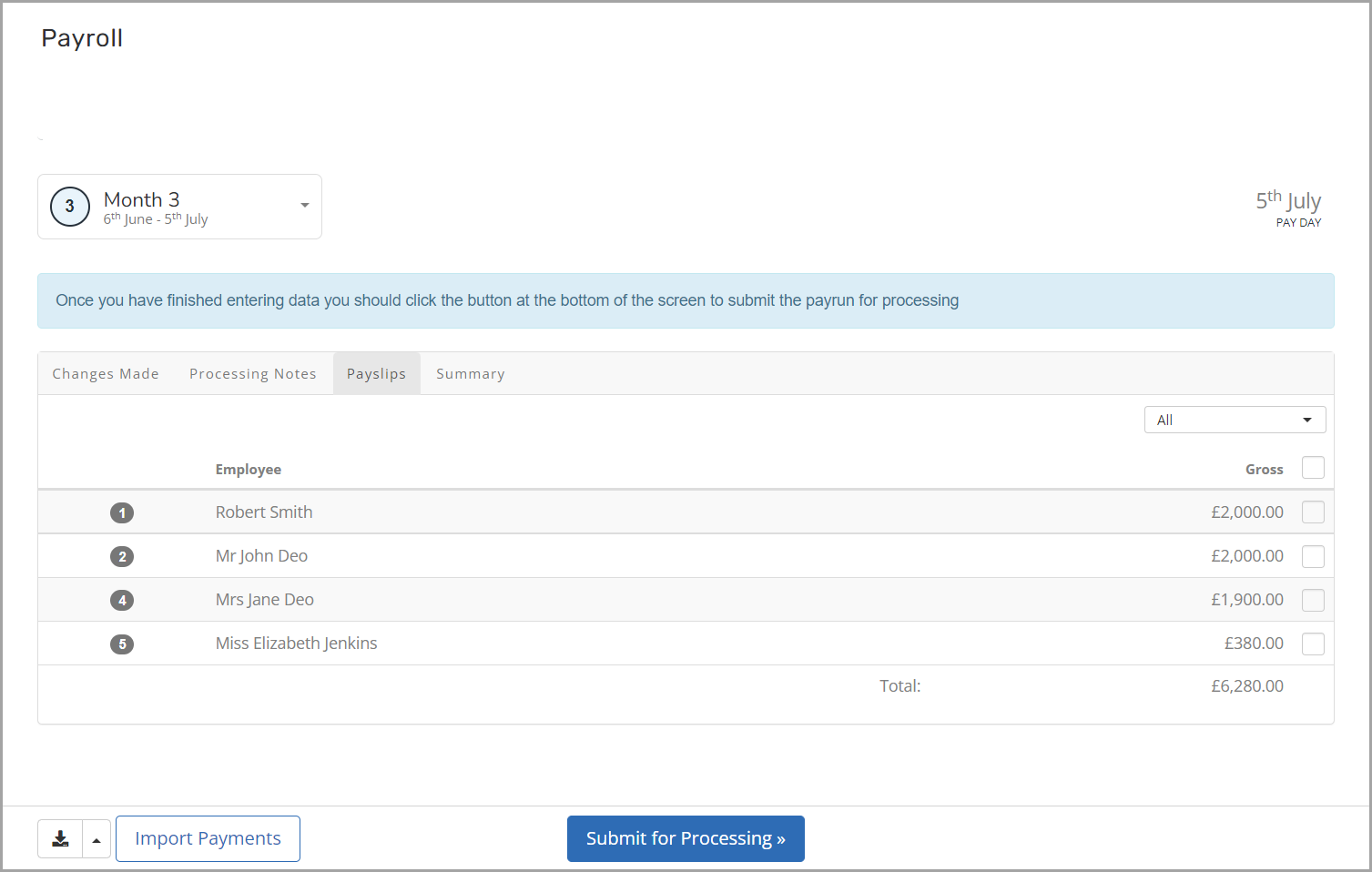

Select Payroll. The Payroll area is displayed with the Payslips tab selected.

-

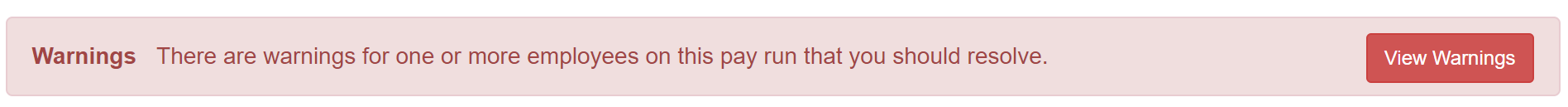

Review Warnings and addresses before you submit. If you have warnings, they appear at the top of the screen.

-

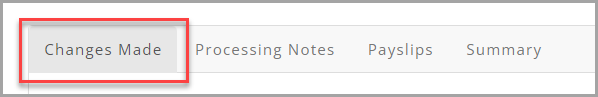

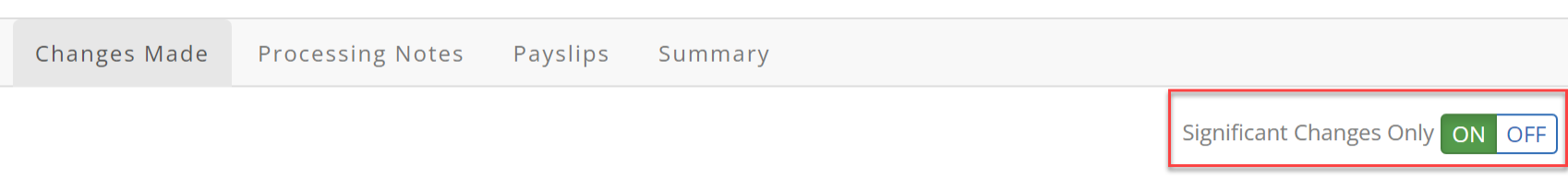

Select the Changes Made tab and review the changes.

You can also view Significant Changes Only, such as bank details changes, using the toggle on the Changes Made section.

-

Select the Processing Notes tab to review or add notes. To add a global note, select Not for a specific employee or select an employee to add the note for them.

-

Select the Payslips tab and review or add variations for each employee.

-

If required, you can select an employee and:

-

Select Edit Regular Pay and update.

-

Select Edit Additions / Deductions and add a New Deduction / Additions.

-

Close the pop up and the Gross changes appear in the list.

-

-

Select Import Payments to import changes made in a spreadsheet. For more information, see Import a new payroll.

-

Select the Summary tab to check the totals for the month and view the payslips.

-

When you've completed the checks, select Submit for Processing.

-

Confirm the employee number and pay date, then select Submit for Processing.

The payroll is now submitted and is locked for review by your Payroll Specialist. You can't make any changes until the Payroll Specialist has completed the payroll process.